Table of contents (click on each section to quickly access the content)

- Investors rights

- Brokerage fees

- Variable management fees: calculation methods

- Order execution and intermediary selection policy

- Application of the Dodd-Frank act by Lazard Frères Gestion

- Complaint handling procedure

- Information from Lazard Frères Banque

- Exercise of voting rights

- Integrity and technical failings

- FATCA

- Solvency II

- Compensation policy

- Gender equality index

- Personal data privacy policy

INVESTORS RIGHTS

For Belgian investors : ADMINISTRATIVE INFORMATION, FEES AND TAXES, AND INVESTORS' RIGHTS

BROKERAGE FEES

Report on brokerage fees for 2023

This report is intended to meet the requirements of Article 314-82 of the General Regulation of the Autorité des Marchés Financiers (French Financial Markets Authority).

As part of managing funds, Lazard Frères Gestion uses order execution services provided by service providers. The brokerage fees incurred by service providers were in excess of €500,000 and Lazard Frères Gestion is therefore required to report on the conditions under which it has used investment decision and order execution support services. It must also report on the breakdown between (1) brokerage fees relating to the reception and transmission service and the order reception service, and (2) brokerage fees relating to investment decision and order execution support services.

Use of investment decision and order execution support services (SADIE)

In the 2023 financial year, Lazard Frères Gestion used the services of investment service providers with which it had entered into a shared commission agreement.

The objective of our policy of best selection and control policy for SADIE providers is to use the best service providers in each speciality (geographical analysis, sector analysis, analysis by capitalisation size, arbitrage, etc.).

With this in mind, we may decide between analysis provided by a sell-side department of an execution broker and analysis available from an independent research firm.

The quality of service provided by SADIE providers will be monitored and assessed by the same committee that analyses and controls execution services provided by Brokers.

The monitoring of SADIE providers and any reallocation of resources between them are carried out using the methodology described below.

Allocation of brokerage fees

Brokerage fees relate to transactions involving equities, similar instruments and futures traded as part of discretionary management and fund management activities. Lazard Frères Gestion is authorised to receive and transmit orders. Brokerage fees are therefore intended to compensate providers of investment decision and order execution support services. 62.5% of the total fee is allocated to decision-making support and 37.5% to order execution support. Fees for investment decision and order execution support services paid to third-party service providers under shared commission agreements represented 14.09% of the total amount of brokerage fees in 2023.

Investment decision support and order execution service fees repaid to third-party services providers in the context of commission sharing agreements represented 14.09% of total intermediation fees paid in 2023.

Prevention of conflicts of interest

This report must also cover the measures put in place to prevent and deal with any conflicts of interest arising as a result of the choice of service providers.

At Lazard Frères Gestion, service providers are selected twice a year at meetings of the Broker Committee, attended by a manager, fund managers, traders, compliance staff and the head of the middle office. Brokers are selected via a transparent selection process based on:

- the quality and availability of research,

- the quality of prices and the execution of orders,

- administrative processing,

- the commercial relationship (relationship with issuers).

In addition, Lazard Frères Gestion does not receive soft commissions or kickbacks on brokerage fees from its service providers.

No conflicts were detected at Lazard Frères Gestion in the 2023 financial year.

PERFORMANCE FEES (VARIABLE MANAGEMENT FEES): CALCULATION METHODS

In accordance with the "Guidelines on performance fees in UCITS and certain types of AIFs" (ESMA34-39-992) of the European Securities and Markets Authority (ESMA) and AMF Recommendation 2021-01, Lazard Frères Gestion will amend the drafting of the procedures it uses to calculate variable management fees for the relevant funds.

The ESMA guidelines aim to promote greater convergence and standardisation in the area of performance fees.

Reminder of the principle of performance fees:

If, at the end of the financial year (the "crystallisation date"), the fund’s performance (net dividends reinvested and excluding variable management fees) is higher than that of its benchmark index, a performance fee is levied, even if the fund’s performance is negative.

New calculation methods:

For each fund affected by these provisions, variable management fees will now be calculated based on the performance achieved by the fund over the previous five years, or since its creation if the fund was launched less than five years ago. Periods of underperformance are thus offset against periods of outperformance in the calculation of variable fees.

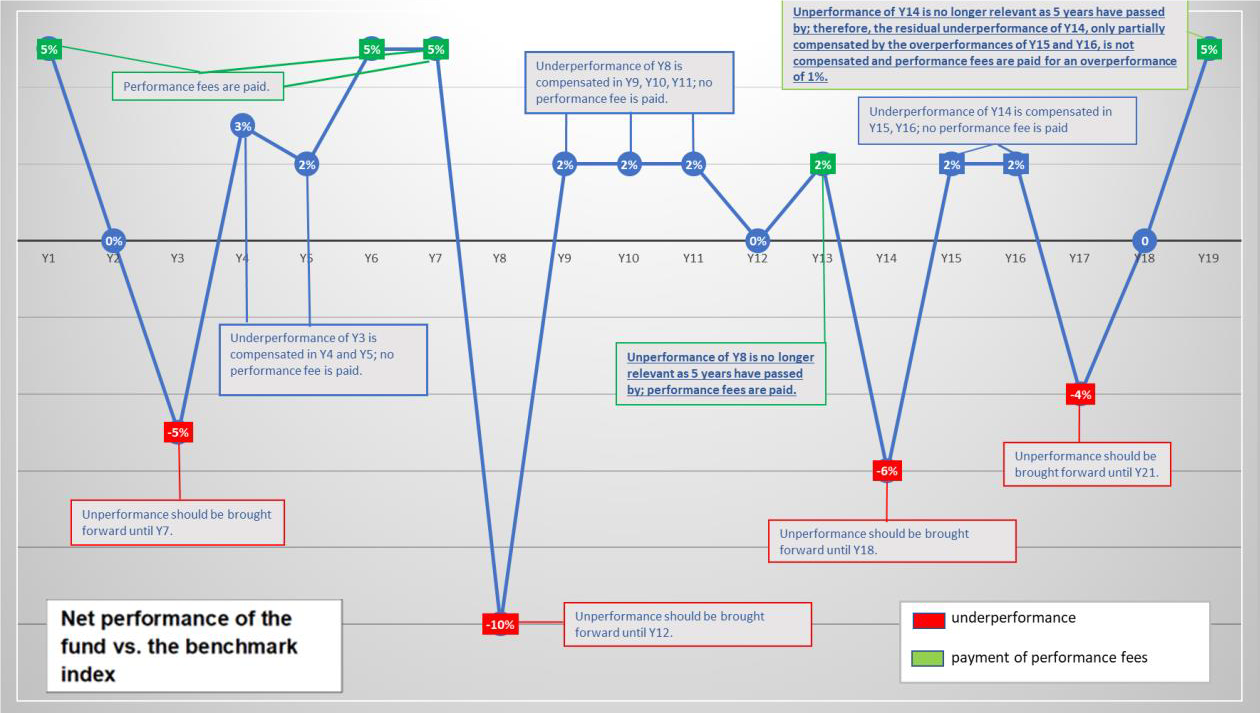

To illustrate how this mechanism works, the ESMA has published an example that Lazard Frères Gestion has included for information purposes. The chart below represents the years of outperformance and underperformance of a fund relative to its benchmark index (blue curve). Only the years with a percentage figure shown in green result in the payment of performance fees.

FIGURE 1 : GENERAL SCENARIO

| |

Net outperformance or underperformance of the fund relative to its benchmark index |

Underperformance to be offset in the following year |

Application of performance fees |

| Year 1 |

5% |

0% |

Yes |

| Year 2 |

0% |

0% |

No |

| Year 3 |

-5% |

-5% |

No |

| Year 4 |

3% |

-2% |

No |

| Year 5 |

2% |

0% |

No |

| Year 6 |

5% |

0% |

Yes |

| Year 7 |

5% |

0% |

Yes |

| Year 8 |

-10% |

-10% |

No |

| Year 9 |

2% |

-8% |

No |

| Year 10 |

2% |

-6% |

No |

| Year 11 |

2% |

-4% |

No |

| Year 12 |

0% |

0%* |

No |

| Year 13 |

2% |

0% |

Yes |

| Year 14 |

-6% |

-6% |

No |

| Year 15 |

2% |

-4% |

No |

| Year 16 |

2% |

-2% |

No |

| Year 17 |

-4% |

-6% |

No |

| Year 18 |

0% |

-4%** |

No |

| Year 19 |

5% |

0% |

Yes |

| |

Year 1 |

| Net performance vs. the benchmark index |

5% |

| Underperformance to be compensated in the following year |

0% |

| Payment of performance fees |

Yes |

| |

Year 2 |

| Net performance vs. the benchmark index |

0% |

| Underperformance to be compensated in the following year |

0% |

| Payment of performance fees |

No |

| |

Year 3 |

| Net performance vs. the benchmark index |

-5% |

| Underperformance to be compensated in the following year |

-5% |

| Payment of performance fees |

No |

| |

Year 4 |

| Net performance vs. the benchmark index |

3% |

| Underperformance to be compensated in the following year |

-2% |

| Payment of performance fees |

No |

| |

Year 5 |

| Net performance vs. the benchmark index |

2% |

| Underperformance to be compensated in the following year |

0% |

| Payment of performance fees |

No |

| |

Year 6 |

| Net performance vs. the benchmark index |

5% |

| Underperformance to be compensated in the following year |

0% |

| Payment of performance fees |

Yes |

| |

Year 7 |

| Net performance vs. the benchmark index |

5% |

| Underperformance to be compensated in the following year |

0% |

| Payment of performance fees |

Yes |

| |

Year 8 |

| Net performance vs. the benchmark index |

-10% |

| Underperformance to be compensated in the following year |

-10% |

| Payment of performance fees |

No |

| |

Year 9 |

| Net performance vs. the benchmark index |

2% |

| Underperformance to be compensated in the following year |

-8% |

| Payment of performance fees |

No |

| |

Year 10 |

| Net performance vs. the benchmark index |

2% |

| Underperformance to be compensated in the following year |

-6% |

| Payment of performance fees |

No |

| |

Year 11 |

| Net performance vs. the benchmark index |

2% |

| Underperformance to be compensated in the following year |

-4% |

| Payment of performance fees |

No |

| |

Year 12 |

| Net performance vs. the benchmark index |

0% |

| Underperformance to be compensated in the following year |

0%* |

| Payment of performance fees |

No |

| |

Year 13 |

| Net performance vs. the benchmark index |

2% |

| Underperformance to be compensated in the following year |

0% |

| Payment of performance fees |

Yes |

| |

Year 14 |

| Net performance vs. the benchmark index |

-6% |

| Underperformance to be compensated in the following year |

-6% |

| Payment of performance fees |

No |

| |

Year 15 |

| Net performance vs. the benchmark index |

2% |

| Underperformance to be compensated in the following year |

-4% |

| Payment of performance fees |

No |

| |

Year 16 |

| Net performance vs. the benchmark index |

2% |

| Underperformance to be compensated in the following year |

-2% |

| Payment of performance fees |

No |

| |

Year 17 |

| Net performance vs. the benchmark index |

-4% |

| Underperformance to be compensated in the following year |

-6% |

| Payment of performance fees |

No |

| |

Year 18 |

| Net performance vs. the benchmark index |

0% |

| Underperformance to be compensated in the following year |

-4%** |

| Payment of performance fees |

No |

| |

Year 19 |

| Net performance vs. the benchmark index |

5% |

| Underperformance to be compensated in the following year |

0% |

| Payment of performance fees |

Yes |

* The underperformance in year 12 to be carried forward to year 13 is 0% (and not -4%) due to the fact that the residual underperformance resulting from year 8 that has not yet been offset (-4%) is no longer included in the calculation. The 5-year period has now passed: the underperformance in year 8 is offset until year 12.

** The underperformance in year 18 to be carried forward to year 19 is -4% (and not -6%) due to the fact that the residual underperformance resulting from year 14 that has not yet been offset (-2%) is no longer included in the calculation. The 5-year period has now passed: the underperformance in year 14 is offset until year 18.

FIGURE 2 : GENERAL SCENARIO WITHOUT ANY PERFORMANCE FEE PAYABLE IN YEARS OF NEGATIVE PERFORMANCE

| |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

| Performance of the Fund's units |

10% |

-4% |

-7% |

6% |

3% |

| Performance of the benchmark |

5% |

-5% |

-3% |

4% |

0% |

| Outperformance/underperformance |

5% |

1% |

-4% |

2% |

3% |

| Cumulative performance of the Fund over the observation period |

10% |

-4% |

-7% |

-1% |

2% |

| Cumulative performance of the benchmark over the observation period |

5% |

-5% |

-3% |

1% |

1% |

| Cumulative outperformance/underperformance over the observation period |

5% |

1% |

-4% |

-2% |

1% |

| Deduction of a fee ? |

Yes |

No, because the Fund's performance is negative, despite outperforming the benchmark |

No, because the fund underperformed the benchmark and its performance was negative over the year |

No, because the fund underperformed over the entire current observation period, beginning in year 3 |

Yes |

| Start of a new observation period ? |

Yes, a new observation period begins in year 2 |

Yes, a new observation period begins in year 3 |

No, the observation period is extended to include years 3 and 4 |

No, the observation period is extended to include years 3, 4 and 5 |

Yes, a new observation period begins in year 6 |

| |

Performance of the Fund's units |

| Year 1 |

10% |

| Year 2 |

-4% |

| Year 3 |

-7% |

| Year 4 |

6% |

| Year 5 |

3% |

| |

Performance of the benchmark |

| Year 1 |

5% |

| Year 2 |

-5% |

| Year 3 |

-3% |

| Year 4 |

4% |

| Year 5 |

0% |

| |

Outperformance/underperformance |

| Year 1 |

5% |

| Year 2 |

1% |

| Year 3 |

-4% |

| Year 4 |

2% |

| Year 5 |

3% |

| |

Cumulative performance of the Fund over the observation period |

| Year 1 |

10% |

| Year 2 |

-4% |

| Year 3 |

-7% |

| Year 4 |

-1% |

| Year 5 |

2% |

| |

Cumulative performance of the benchmark over the observation period |

| Year 1 |

5% |

| Year 2 |

-5% |

| Year 3 |

-3% |

| Year 4 |

1% |

| Year 5 |

1% |

| |

Cumulative outperformance/underperformance over the observation period |

| Year 1 |

5% |

| Year 2 |

1% |

| Year 3 |

-4% |

| Year 4 |

-2% |

| Year 5 |

1% |

| |

Deduction of a fee ? |

| Year 1 |

Yes |

| Year 2 |

No, because the Fund's performance is negative, despite outperforming the benchmark |

| Year 3 |

No, because the fund underperformed the benchmark and its performance was negative over the year |

| Year 4 |

No, because the fund underperformed over the entire current observation period, beginning in year 3 |

| Year 5 |

Yes |

| |

Start of a new observation period ? |

| Year 1 |

Yes, a new observation period begins in year 2 |

| Year 2 |

Yes, a new observation period begins in year 3 |

| Year 3 |

No, the observation period is extended to include years 3 and 4 |

| Year 4 |

No, the observation period is extended to include years 3, 4 and 5 |

| Year 5 |

Yes, a new observation period begins in year 6 |

NB: To make the example easier to understand, we have stated the performances of the Fund and the benchmark as percentages. Outperformance/underperformance will, in reality, be measured as an amount, i.e. the difference between the net assets of the Fund and those of a fictitious fund as described in the above methodology.

FIGURE 3 : GENERAL SCENARIO WITH A PERFORMANCE FEE PAYABLE IN YEARS OF NEGATIVE PERFORMANCE

| |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

| Performance of the Fund's units |

10% |

-4% |

-7% |

6% |

3% |

| Performance of the benchmark |

5% |

-5% |

-3% |

4% |

0% |

| Outperformance/underperformance |

5% |

1% |

-4% |

2% |

3% |

| Cumulative performance of the Fund over the observation period |

10% |

-4% |

-7% |

-1% |

2% |

| Cumulative performance of the benchmark over the observation period |

5% |

-5% |

-3% |

1% |

1% |

| Cumulative outperformance/underperformance over the observation period |

5% |

1% |

-4% |

-2% |

1% |

| Deduction of a fee ? |

Yes |

Yes |

No, as the fund underperformed the benchmark |

No, because the fund underperformed over the entire current observation period, beginning in year 3 |

Yes |

| Start of a new observation period ? |

Yes, a new observation period begins in year 2 |

Yes, a new observation period begins in year 3 |

No, the observation period is extended to include years 3 and 4 |

No, the observation period is extended to include years 3, 4 and 5 |

Yes, a new observation period begins in year 6 |

| |

Performance of the Fund's units |

| Year 1 |

10% |

| Year 2 |

-4% |

| Year 3 |

-7% |

| Year 4 |

6% |

| Year 5 |

3% |

| |

Performance of the benchmark |

| Year 1 |

5% |

| Year 2 |

-5% |

| Year 3 |

-3% |

| Year 4 |

4% |

| Year 5 |

0% |

| |

Outperformance/underperformance |

| Year 1 |

5% |

| Year 2 |

1% |

| Year 3 |

-4% |

| Year 4 |

2% |

| Year 5 |

3% |

| |

Cumulative performance of the Fund over the observation period |

| Year 1 |

10% |

| Year 2 |

-4% |

| Year 3 |

-7% |

| Year 4 |

-1% |

| Year 5 |

2% |

| |

Cumulative performance of the benchmark over the observation period |

| Year 1 |

5% |

| Year 2 |

-5% |

| Year 3 |

-3% |

| Year 4 |

1% |

| Year 5 |

1% |

| |

Cumulative outperformance/underperformance over the observation period |

| Year 1 |

5% |

| Year 2 |

1% |

| Year 3 |

-4% |

| Year 4 |

-2% |

| Year 5 |

1% |

| |

Deduction of a fee ? |

| Year 1 |

Yes |

| Year 2 |

Yes |

| Year 3 |

No, as the fund underperformed the benchmark |

| Year 4 |

No, because the fund underperformed over the entire current observation period, beginning in year 3 |

| Year 5 |

Yes |

| |

Start of a new observation period ? |

| Year 1 |

Yes, a new observation period begins in year 2 |

| Year 2 |

Yes, a new observation period begins in year 3 |

| Year 3 |

No, the observation period is extended to include years 3 and 4 |

| Year 4 |

No, the observation period is extended to include years 3, 4 and 5 |

| Year 5 |

Yes, a new observation period begins in year 6 |

NB : To make the example easier to understand, we have stated the performances of the Fund and the benchmark as percentages. Outperformance/underperformance will, in reality, be measured as an amount, i.e. the difference between the net assets of the Fund and those of a fictitious fund as described in the above methodology.

FIGURE 4 : HOW PERFORMANCES THAT ARE NOT OFFSET ARE DEALT WITH AFTER 5 YEARS

| |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

| Performance of the Fund's units |

0% |

5% |

3% |

6% |

1% |

5% |

| Performance of the benchmark |

10% |

2% |

6% |

0% |

1% |

1% |

| A: Outperformance/underperformance for the year to date |

-10% |

3% |

-3% |

6% |

0% |

4% |

| B1: Non-offset underperformance carried forward Year 1 |

N/A |

-10% |

-7% |

-7% |

-1% |

Outside scope |

| B2: Non-offset underperformance carried forward Year 2 |

N/A |

N/A |

0% |

0% |

0% |

0% |

| B3: Non-offset underperformance carried forward Year 3 |

N/A |

N/A |

N/A |

-3% |

-3% |

-3% |

| B4: Non-offset underperformance carried forward Year 4 |

N/A |

N/A |

N/A |

N/A |

0% |

0% |

| B5: Non-offset underperformance carried forward Year 5 |

N/A |

N/A |

N/A |

N/A |

N/A |

0% |

| Outperformance/underperformance over the observation period |

-10% (A) |

-7% (A + B1) |

-10% (A + B1 + B2) |

-4% (A + B1 + B2 + B3) |

-4% (A + B1 + B2 + B3 + B4) |

1% (A + B2 + B3 + B4 + B5) |

| Deduction of a fee ? |

No |

No |

No |

No |

No |

Yes |

| |

Performance of the Fund's units |

| Year 1 |

0% |

| Year 2 |

5% |

| Year 3 |

3% |

| Year 4 |

6% |

| Year 5 |

1% |

| Year 6 |

5% |

| |

Performance of the benchmark |

| Year 1 |

10% |

| Year 2 |

2% |

| Year 3 |

6% |

| Year 4 |

0% |

| Year 5 |

1% |

| Year 6 |

1% |

| |

A: Outperformance/underperformance for the year to date |

| Year 1 |

-10% |

| Year 2 |

3% |

| Year 3 |

-3% |

| Year 4 |

6% |

| Year 5 |

0% |

| Year 6 |

4% |

| |

B1: Non-offset underperformance carried forward Year 1 |

| Year 1 |

N/A |

| Year 2 |

-10% |

| Year 3 |

-7% |

| Year 4 |

-7% |

| Year 5 |

-1% |

| Year 6 |

Outside scope |

| |

B2: Non-offset underperformance carried forward Year 2 |

| Year 1 |

N/A |

| Year 2 |

N/A |

| Year 3 |

0% |

| Year 4 |

0% |

| Year 5 |

0% |

| Year 6 |

0% |

| |

B3: Non-offset underperformance carried forward Year 3 |

| Year 1 |

N/A |

| Year 2 |

N/A |

| Year 3 |

N/A |

| Year 4 |

-3% |

| Year 5 |

-3% |

| Year 6 |

-3% |

| |

B4: Non-offset underperformance carried forward Year 4 |

| Year 1 |

N/A |

| Year 2 |

N/A |

| Year 3 |

N/A |

| Year 4 |

N/A |

| Year 5 |

0% |

| Year 6 |

0% |

| |

B5: Non-offset underperformance carried forward Year 5 |

| Year 1 |

N/A |

| Year 2 |

N/A |

| Year 3 |

N/A |

| Year 4 |

N/A |

| Year 5 |

N/A |

| Year 6 |

0% |

| |

Outperformance/underperformance over the observation period |

| Year 1 |

-10% (A) |

| Year 2 |

-7% (A + B1) |

| Year 3 |

-10% (A + B1 + B2) |

| Year 4 |

-4% (A + B1 + B2 + B3) |

| Year 5 |

-4% (A + B1 + B2 + B3 + B4) |

| Year 6 |

1% (A + B2 + B3 + B4 + B5) |

| |

Deduction of a fee ? |

| Year 1 |

No |

| Year 2 |

No |

| Year 3 |

No |

| Year 4 |

No |

| Year 5 |

No |

| Year 6 |

Yes |

The underperformance generated in year 1 and partially offset in subsequent years becomes irrelevant in year 6.

ORDER EXECUTION AND INTERMEDIARY SELECTION POLICY

DOWNLOAD THE ORDER EXECUTION AND INTERMEDIARY SELECTION POLICY.

DOWNLOAD THE ANNUAL REPORT ON THE EXECUTION OF ORDER.

APPLICATION OF THE DODD-FRANK ACT BY LAZARD FRERES GESTION

Lazard Frères Gestion SAS does not provide any investment service, directly or indirectly, to clients or investors categorised as "US persons” (as defined by Rule 902 of Regulation S under the United States Securities Act of 1933). In addition, Lazard Frères Gestion SAS will not accept potential clients or investors:

(i) who acquire financial instruments for or on behalf of a US person or

(ii) through whom an investment service is provided for or on behalf of a US person

COMPLAINT HANDLING PROCEDURE

LFG notifies its Clients that it has a complaint handling procedure in place. To be dealt with as effectively as possible, any complaint sent by post must be addressed to the Legal Department of Lazard Frères Gestion at 25, rue de Courcelles, 75008 Paris.

Lazard Frères Gestion undertakes to acknowledge receipt of the complaint within 10 business days of receipt, unless a response is provided within that period, and to respond within two months of receipt of the complaint unless there are specific duly justified circumstances. However, if the Client is not fully satisfied with the response provided by Lazard Frères Gestion, they may refer the matter to the AMF's Ombudsman in writing (Autorité des Marchés Financiers, Service Médiation - 17, place de la Bourse, 75082 PARIS-CEDEX 02) or by filling in an electronic form on the AMF's website http://www.amf-france.org (under the heading AMF Ombudsman). The AMF Ombudsman applies a mediation charter that is available on the aforementioned website.

In relation to our brokerage activities, investors may send complaints directly to LFG Courtage by calling 01 44 13 01 11 or by sending an email to LFG.JURIDIQUE@LAZARD.FR. LFG Courtage undertakes to acknowledge receipt of the complaint within 10 business days of receipt, unless a response is provided within that period, and to respond within two months of receipt of the complaint unless there are specific duly justified circumstances. If the policyholder disagrees with LFG Courtage, they may refer the matter to the mediator at La Médiation de l’Assurance by writing to La Médiation de l’Assurance TSA 50110 – 75441 Paris Cedex 09 - France.

Lazard Frères Banque informs its clients that its guide to banking mobility is available from its branch at 175 boulevard Haussmann, Paris 8th arrondissement.

EXERCISE OF VOTING RIGHTS

DOWNLOAD THE LATEST REPORT ON THE EXERCISE OF VOTING RIGHTS.

INTEGRITY AND TECHNICAL FAILINGS

The security and integrity of communications via the Internet cannot be guaranteed. Lazard Frères Gestion does not therefore accept any liability in the event of any technical failings, particularly in the event of issues encountered in accessing the website or interrupting the publication of the website.

FATCA

The purpose and legal framework of FATCA

The Foreign Account Tax Compliance Act (FATCA) is a US law enacted on 18 March 2010 that seeks to combat tax evasion in the United States of America. Under FATCA, US taxpayers are required to submit an annual return to the US Internal Revenue Service (IRS) for any accounts they hold outside the United States.

US tax law requires US taxpayers, regardless of their place of residence, to submit their own return.

The law applies to “U.S. Persons”, i.e. all persons with US nationality and persons resident in the United States. Its purpose is to obtain information from financial institutions on the identity of these persons, the balances held in their accounts, their financial income and, in the future, proceeds from the sale of securities.

The first annual returns to the IRS were submitted in 2015 and related to 2014. This return will also cover the accounts of companies or asset-holding structures owned by US taxpayers.

In France, the application of FATCA is part of the legal framework set out in an Intergovernmental Agreement (IGA) signed on 14 November 2013 and submitted to Parliament for ratification. It seeks to allow banking and tax information to be disclosed between France and the United States and to make such disclosure mandatory.

How FATCA affects Lazard

From 1 July 2014, Lazard Frères Banque and Lazard Frères Gestion are required to comply with FATCA as a result of being categorised as “Participating Financial Institutions” by the IRS.

As such, Lazard Frères Banque and Lazard Frères Gestion apply the client identification obligations provided for by FATCA.

When opening an account, Lazard obtains from Clients, whether individuals or legal entities, information that identifies whether they are a "U.S. Person" and asks Clients to confirm their status.

Information provided by Lazard's existing Clients is also analysed to determine whether there are any indications that these Clients may be "U.S. Persons". The Clients in question will be contacted so that their FATCA status can be established.

Clients should contact their usual contacts if they require any additional information.

SOLVENCY II

Pursuant to AMF Position 2004-07, Lazard Frères Gestion SAS informs the unitholders and/or shareholders of the funds that it manages that it may be required to send details of the composition of the portfolios of these funds to certain professional investors for the purposes of calculating the regulatory requirements under Directive 2009/138/EC (“Solvency 2”).

COMPENSATION POLICY

Information about the fixed and variable compensation paid by the management company to its employees, in proportion to the investment made in the management of funds, excluding discretionary management, may be obtained by post from Lazard Frères Gestion fund legal department.

The aggregate amount of variable compensation is set by the Lazard Group based on various criteria, including the financial performance of the Lazard Group over the past year, and takes account of Lazard Frères Gestion's results.

The Executive Management team decides on the total amount of compensation to be split between fixed and variable compensation, in accordance with the principle that the fixed component of compensation is absolutely separate from the variable component.

The aggregate amount of variable compensation must not be such that it prevents the Lazard Group and Lazard Frères Gestion from strengthening its capital position when necessary.

All risks and conflicts of interest are factored into the calculation of the aggregate amount of variable compensation.

The amount of variable compensation is then individually calculated and is, in part, based on the performance of each Identified Employee.

The Executive Management team supervises the calculation of individual compensation amounts via an individual assessment form, which is used in the annual appraisal interview.

The annual individual assessment criteria are used to determine the suitability of Identified Employees for the positions they hold, to take their expertise into consideration and to assess their reliability and autonomy.

This assessment is used to report on the achievement of targets over the past year and to accordingly set future targets.

The compensation policy encourages rigorous and effective risk management in the area of sustainable development. As such, the assessment of Identified Employees takes account of both financial risks and also sustainability risks.

The compensation policy is reviewed each year.

Each year, Lazard Frères Gestion's the committee responsible for monitoring compliance with the compensation policy, made up of two members independent of the management company, is responsible for issuing an opinion on the application of the compensation policy and on its compliance with applicable laws.

GENDER EQUALITY INDEX

The law on the freedom to make career choices of 5 September 2018 aims to reduce the gender pay gap through binding measures. Equal pay for women and men is now an absolute obligation rather than a “best endeavours” commitment. Since 2019, companies with more than 250 employees, and since 2020, companies with 50 or more employees, have been subject to a duty to provide transparent information on identified pay gaps, while strengthening the ability of labour inspectorates to carry out checks.

The index takes the form of a score out of 100 consists of 4 indicators that measure different data on gender equality:

- gender pay gap (40 points)

- difference in the rate of increase in basic salaries between men and women (35 points)

- percentage of female employees who received a pay rise in the year in which they returned from maternity leave (15 points)

- number of employees of the under-represented gender (men or women) in the company's 10 highest earners (10 points)

If the resulting score is less than 75 points, the employer has 3 years to take corrective action. At the end of that period, it will incur a financial penalty.

For 2023, Lazard Frères Gestion achieved a score of 94 out of 100.

PERSONAL DATA PRIVACY POLICY

VIEW OUR POLICY